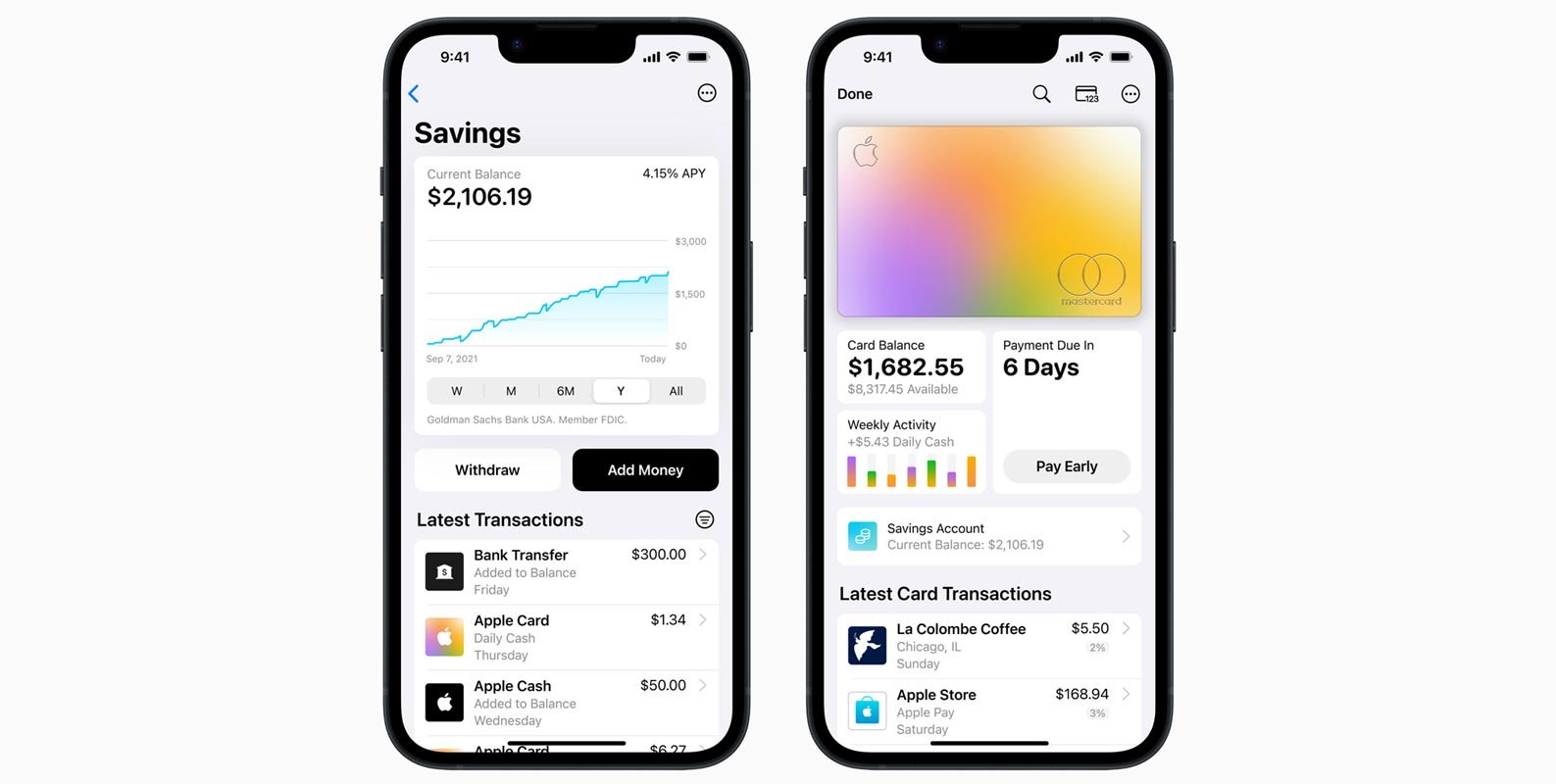

Apple has recently launched a high-yield savings Account exclusively for Apple Card owners in the United States. The Account offers an impressive annual percentage yield (APY) of 4.15 percent, significantly higher than the national average for savings accounts. Apple aims to strengthen customer loyalty and enhance user experience by introducing this financial service to its users. This savings account is designed to work seamlessly with the Apple Wallet app, providing easy access and management of funds. Users can deposit and withdraw anytime without minimum balance requirements or monthly fees. Additionally, the funds in the savings account are FDIC-insured for up to $10,000, ensuring the safety of the user’s money.

What is the Apple Card Savings Account?

The Apple Card Savings Account is a high-yield savings Account offered to card owners in the US. The savings account is provided by Goldman Sachs, the same company that offers the Marcus account. The Apple Card Savings Account is built for mobile users who prefer not to visit physical banks. The Account is accessible through the iPhone’s Wallet app and offers a 4.15 percent annual percentage yield.

How to Sign Up for the Apple Card Savings Account?

To sign up for the Apple Card Savings Account, you must have an Apple Card and meet the eligibility criteria. Once you complete the eligibility requirements, you can access the savings Account through the Wallet app on your iPhone.

Eligibility Criteria for the Apple Card Savings Account

To be eligible for the Apple Card Savings Account, you must meet the following requirements:

- You must have an Apple Card.

- You must be a US citizen or a resident with a valid US mailing address.

- You must have at least iOS 16.4 installed on your iPhone.

- You must meet the account opening requirements set by Goldman Sachs.

What are the Benefits of the Apple Card Savings Account?

The Apple Card Savings Account offers the following benefits to its users:

- High yield: The savings account offers a 4.15 percent annual percentage yield, more elevated than the national average.

- No fees are associated with the savings account, including no minimum deposit requirements.

- Flexibility: You can transfer money from your Apple Cash balance or a linked bank account. You can also automatically deposit your Daily Cash from purchases.

- Accessibility: The savings account is accessible through the Wallet app on your iPhone, providing convenience and ease of use.

How to Deposit Funds into the Apple Card Savings Account?

You can deposit funds into the Apple Card Savings Account by transferring money from your Apple Cash balance or a linked bank account. You can also automatically deposit your Daily Cash from purchases.

How to Withdraw Funds from the Apple Card Savings Account?

You can withdraw money from the Apple Card Savings Account at any time. To withdraw funds, you must transfer the money to your Apple Cash balance or a linked bank account.

Limitations of the Apple Card Savings Account

- The maximum account balance is limited to $250,000.

- Transfers to or from Apple Cash must range between $1 and $10,000.

- The weekly transfer limit is $20,000.

How is the Apple Card Savings Account Different from Marcus’?

- Apple Card Savings Account offers a higher yield of 4.15% compared to Marcus’ 2.15% yield.

- Apple Card Savings Account is tied to the iPhone’s Wallet app, while Marcus is a standalone account.

- There are restrictions on transfers to or from Apple Cash, which must be within $1 to $10,000. In contrast, Marcus has no such constraints.

Is the Apple Card Savings Account Safe and Secure?

- Yes, the Apple Card Savings Account is backed by Goldman Sachs and FDIC-insured up to $250,000.

- Apple has also implemented multiple security measures, such as biometric and two-factor authentication, to protect users’ accounts.

What are the Alternatives to the Apple Card Savings Account?

- Marcus by Goldman Sachs

- Ally Bank Online Savings Account

- Synchrony Bank High Yield Savings Account

- American Express Personal Savings Account

How Does the Apple Card Savings Account Fit into Apple’s Financial Strategy?

- The Apple Card Savings Account is part of a larger strategy to bring more financial services in-house.

- This allows Apple to control more of its customer experience and keep users within the Apple ecosystem.

Can Non-US Citizens Sign Up for the Apple Card Savings Account?

- No, the Apple Card and Apple Card Savings Account are only available to US residents with a US mailing address, a valid US phone number, and a valid Social Security Number or Individual Taxpayer Identification Number (ITIN).

FAQs

Can I sign up for the Apple Card Savings Account if I don’t have an Apple Card?

No, the savings account is exclusively available for Apple Card holders.

Is the Apple Card Savings Account FDIC-insured?

Yes, the savings account is FDIC-insured up to $250,000.

How does the interest rate of the Apple Card Savings Account compare to other savings accounts?

The interest rate of 4.15% APY is higher than the national average for savings accounts, making it an attractive option for Apple Card holders.

Can I withdraw money from the Apple Card Savings Account at any time?

Indeed, you can withdraw from the savings account without incurring any charges or penalties, regardless of when you do so.

Is a minimum deposit required to open an Apple Card Savings Account?

No, there is no minimum deposit required to open an account.

Can I link multiple bank accounts to my Apple Card Savings Account?

Indeed, it’s possible to connect multiple bank accounts to facilitate the transfer of funds to and from your savings account.

Can I access my Apple Card Savings Account from a desktop computer?

No, You can access the savings Account through the Wallet app on an iPhone or iPad.

Can I set up automatic deposits to my Apple Card Savings Account?

Indeed, it’s possible to set up automatic deposits from your Apple Cash balance or a linked bank account.

How does the Apple Card Savings Account fit into Apple’s ecosystem?

The savings account is part of Apple’s strategy to offer more financial services in-house and keep users within the Apple ecosystem.

Can I earn rewards on the money deposited in my Apple Card Savings Account?

No rewards or cashback for the money in the savings account.

Wrap Up

The Apple Card Savings Account is part of Apple’s larger strategy to bring more financial services in-house, ultimately keeping users within the Apple ecosystem. The Apple Card Savings Account is a high-yield savings account available exclusively to Apple Card holders. While it offers a competitive yield and convenient integration with the iPhone’s Wallet app, limitations include the maximum account balance and transfer restrictions. However, it is a safe and secure option backed by Goldman Sachs and FDIC-insured up to $250,000. Other high-yield savings accounts are available from reputable banks for those seeking alternatives.

Selva Ganesh is a Computer Science Engineer, Android Developer, and Tech Enthusiast. As the Chief Editor of this blog, he brings over 10 years of experience in Android development and professional blogging. He has completed multiple courses under the Google News Initiative, enhancing his expertise in digital journalism and content accuracy. Selva also manages Android Infotech, a globally recognized platform known for its practical, solution-focused articles that help users resolve Android-related issues.

Leave a Reply